A leading global Private Equity firm was facing delays and inefficiencies in its credit approval workflow. CAM generation routinely took 2–3 weeks, driven by ingestion friction, inconsistent data, and limited accuracy from traditional document processing tools.

The problem

The firm’s credit approval process was burdened by:

- Multi-format document ingestion issues across PDFs, spreadsheets, and scanned statements

- Inconsistent financial data structures, complicating downstream analysis

- 2–3 week turnaround times for CAM generation

- Accuracy limitations with existing document processing and analysis solutions

The solution

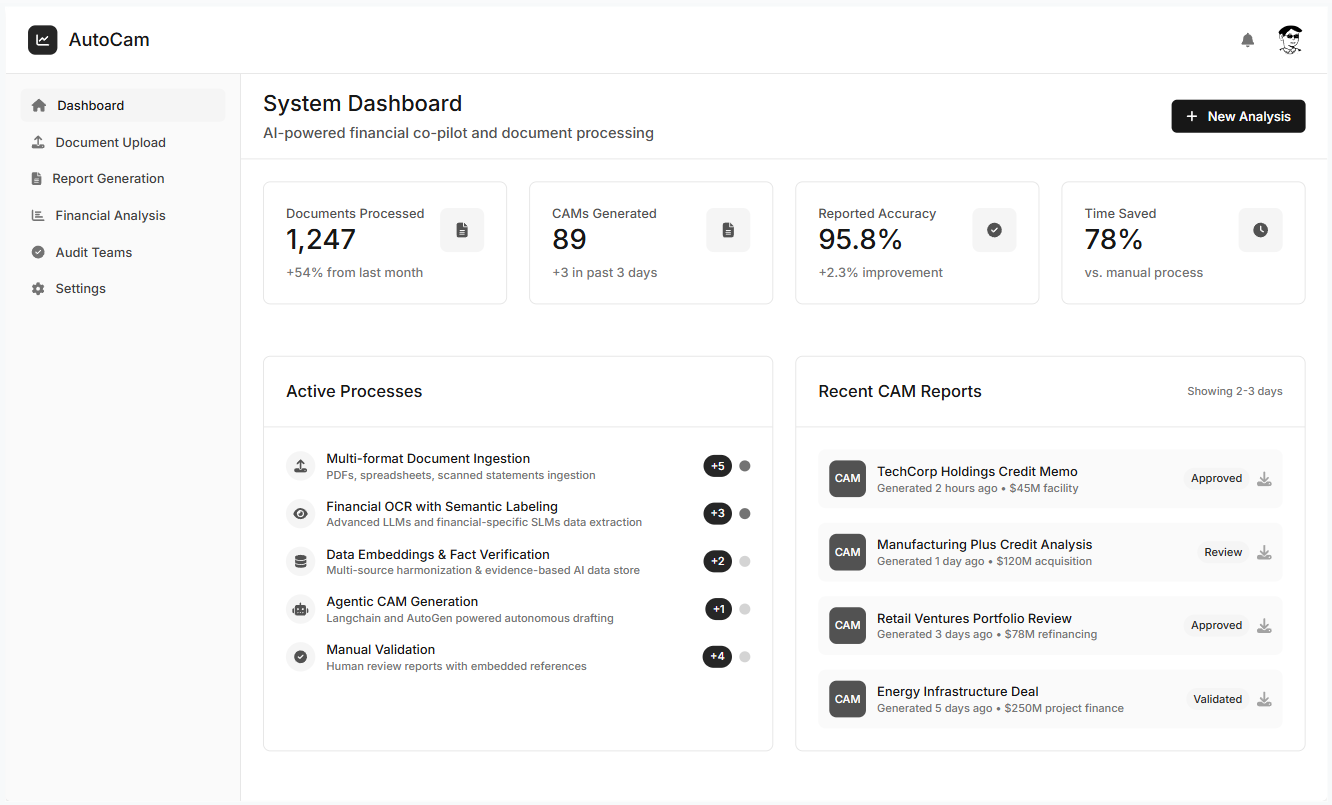

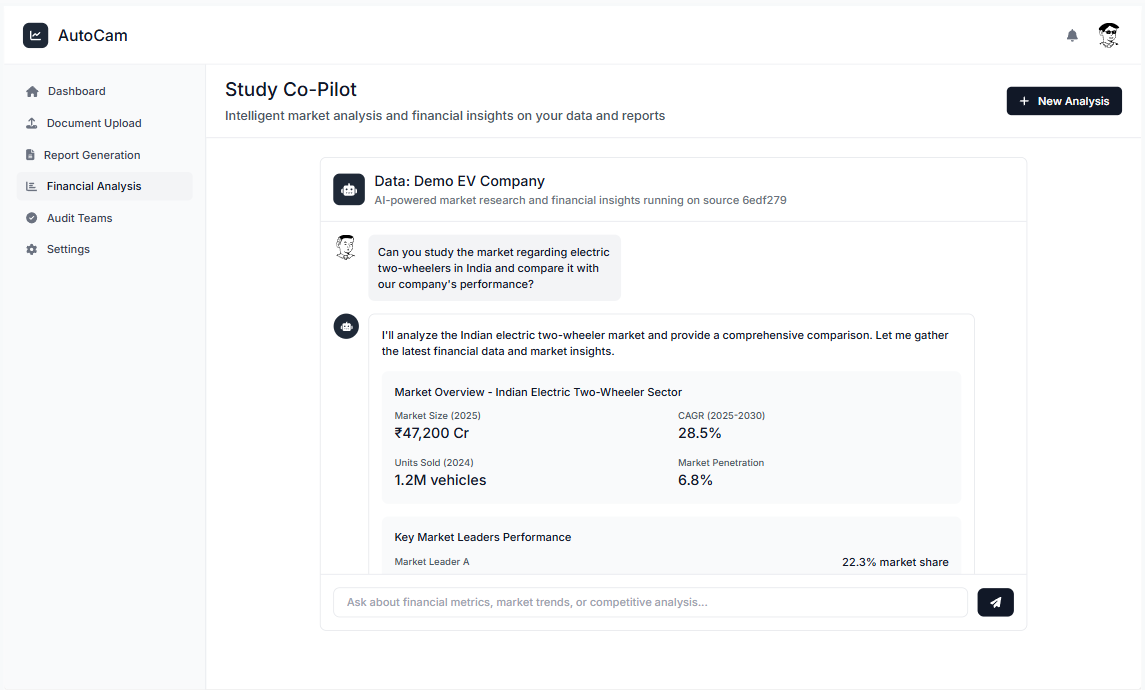

We deployed AutoCam — a comprehensive AI-powered financial analyst system designed to streamline and automate the end-to-end CAM workflow.

Advanced Financial OCR with Semantic Labeling

AutoCam introduced a robust financial OCR + extraction pipeline using advanced LLMs and financial-specific SLMs to process multi-format inputs (including scanned documents). After extraction, semantic labeling aligned raw outputs to accounting standards and business rules, producing clean, standardized financial structures ready for analysis.

AI-powered data integration and fact verification

A multi-source integration engine harmonized extracted data from:

- financial reports

- bank statements

- operational and supporting documents

All data was consolidated into a central datastore. On top of this, an evidence-based fact verification layer ensured computed metrics remained traceable, auditable, and highly reliable—reducing analyst rework and increasing confidence in final CAM outputs.

Agentic CAM generation engine

Using LangChain and AutoGen, we built an agentic CAM generation system that can autonomously draft CAMs with:

- embedded evidence references

- peer benchmarks and comparable context

- decision-ready narrative and rationale

The output is structured for final analyst validation, keeping humans in the loop while removing the repetitive drafting overhead.

Results

AutoCam delivered measurable improvements across the workflow:

- 80% automation of the CAM creation process

- Turnaround time reduced from 2–3 weeks to 2 days

- Faster investment committee decisions through quicker CAM availability

- High data reliability via traceable, verifiable financial facts